wyoming llc tax rate

If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced income. 100 of Fair Market Value.

What S The Llc Tax Rate How Limited Liability Companies Are Taxed Bench Accounting

It applies to all the earnings you withdraw from your business.

. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company. Additionally counties may charge up to an additional 2 sales tax. Wyoming residential and commercial property taxes can be.

Up to 25 cash back In conjunction with the annual report you must pay a license tax. State Assessment of Minerals. Similarly a sole member LLC may be taxable.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. 50 or 00002 of the value of all. The current self-employment tax rate is 153 percent.

The state of Wyoming charges a 4 sales tax. What makes the Wyoming LLC an appealing vehicle for doing. Sure I can address your tax questions.

Wyoming does not place a tax on retirement income. There is no tax to the LLC on LLC income. When calculating the sales tax for this purchase Steve applies the 40 tax rate for Wyoming State plus 10 for Hot Springs County.

A Wyoming Limited Liability Company LLC is a business entity formed in Wyoming and governed by Wyoming statutes. Wyoming LLCs pay a 30 percent tax on all income from US. We include everything you need for the LLC.

Wyoming sales tax details. The LLC must file. A Wyoming LLC also has to file an annual report with the secretary of state.

All members or managers who take profits out of the LLC must pay self-employment tax. Depending on local municipalities the total tax rate can be as high as 6. For industrial lands this percentage goes up to 115 percent.

Wyoming requires LLCs to file an annual report with the Secretary of State and pay an annual license tax. Personal Service Corporations may be taxed at a different rate. For any income under 60000 the graduated tax rate is between 22 to 555 The maximum income tax rate is 660 on income of 60000 or over.

This tax is administered by the Federal Insurance Contributions Act FICA which covers Social Security and Medicare and other benefits. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. The annual report fee is based on assets located in Wyoming.

115 of Fair Market Value. The sales tax is about 542 which is fairly low. This will cost you 325 for a corporation or an LLC.

Delaware also charges a franchise tax. Assuming the above facts were true Craigs Wyoming LLC is subject to California taxes and to the 800 Annual Franchise Tax and to the LLC Estimated Fee. This is the state.

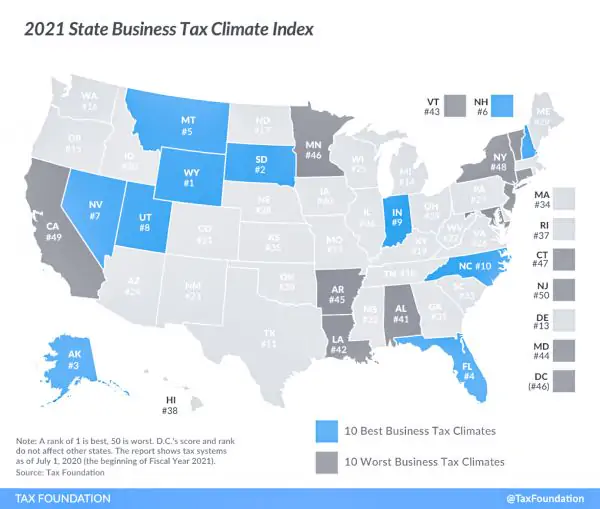

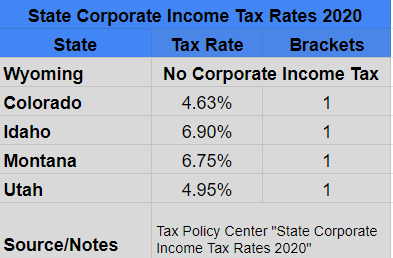

Thus the total cost of sales tax is 1750. Answer 1 of 3. Wyoming has no corporate income tax at the state level making it.

Prescription drugs and groceries. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming. State Assessment of Industrial Land.

The tax is either 60 minimum or 0002 per dollar of. First a legal LLC in the US with one member has a default tax status of tax disregarded entity for tax purposes as noted in. If your business is responsible for collecting and remitting Wyoming sales tax you need to register with the Wyoming Department of Revenue.

Wyoming does have relatively high property tax but if you dont own a home in Wyoming youll never know the difference. The LLC will file an IRS form 1065 income tax return but does not pay income taxes. The tax is calculated at a rate of two-tenths of one mill on the dollar based on the value of your LLCs.

File Your Annual Report. State wide sales tax is 4. The Wyoming WY state sales tax rate is currently 4.

One tax rate of 21 applies to taxable income. For residential and commercial property the tax collected is 95 percent of the value of the property. 9 rows Tax Rate 0.

However it may also elect taxation as a C or S corporation. What is the Wyoming.

Wyoming Sales Tax Small Business Guide Truic

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

How To Choose Your Llc Tax Status Truic

10 Best States To Form An Llc Infographic Business Infographic States Infographic

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Corporate Income Tax Definition Taxedu Tax Foundation

Beer Tax In America Infographic Beer Facts Beer Industry Beer

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Daily Viz From Visual Loop 30 08 2010 Scholarships For College Nursing School Scholarships Student Debt Infographic

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

Aarp S 10 Most Affordable Places To Live In America Cheapest Places To Live Best Places To Move Cheap Places To Travel

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer